The Nachiket Mor Committee was named after its esteemed chairman, Mr. Nachiket Mor. He was the board member of RBI. He played a pivotal role in shaping India’s financial inclusion agenda. The committee was formed in the year 2013 and was tasked with devising strategies to enhance access to financial services for all segments of society, particularly the marginalized and underserved.

Table of Contents

Why Nachiket Mor Committee was appointed?

India has vast population and diverse socio-economic landscape. It has faced challenges in ensuring universal access to financial services. The Nachiket Mor Committee was established against this backdrop to examine ways to overcome these barriers and drive financial inclusion. The committee aimed to devise a comprehensive framework that would bridge the gaps in access to banking, insurance, and other financial services.

Key Recommendations

1. Bank Account for Each Adult Citizen: One of the significant recommendations put forth by the committee was to have Bank Account for every individual above the age of 18. This initiative aimed to provide a basic savings account to all, facilitating access to formal banking services and enabling individuals to build financial identities.

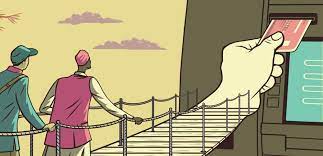

2. Payment Access Points: To enhance accessibility, the committee proposed the creation of Payment Access Points (PAPs) in remote and underserved areas. These PAPs, operated by authorized agents, would offer basic banking services, such as deposits, withdrawals, and fund transfers, bridging the gap between traditional banking infrastructure and remote communities.

3. Promote Mobile Banking: Recognizing the transformative potential of technology, the committee emphasized the adoption of digital platforms and mobile banking to extend financial services to the masses. It recommended leveraging existing infrastructure, such as the Unique Identification Authority of India (UIDAI) database and mobile networks, to facilitate secure and convenient transactions.

4. Credit and Insurance Accessibility: The committee highlighted the need to improve access to credit and insurance for vulnerable and marginalized segments of society. It recommended innovative approaches, such as risk-sharing mechanisms, micro-insurance, and targeted lending programs, to empower underserved communities and facilitate their inclusion into the formal financial system.

5. Stop Loan Waiver to Farmer: The Nachiket Mor committee recommended to do away with the loan waiver of the farmers.

6. Abolish SLR and Reduce CRR: The committee recommended to abolish the Statutory Liquidity Ration in order to boost the liquidity in the market. It recommended for the reduction in Cash Reserve Ratio.

7. Increase Priority Sector Lending: The committee recommended for boosting the lending to neglected section and sectors of the society.

The Nachiket Mor Committee’s recommendations and subsequent reforms have had a profound impact on financial inclusion in India. The introduction of Universal Electronic Bank Accounts has expanded the reach of formal banking services, bringing millions of previously unbanked individuals into the financial mainstream. The establishment of Payment Access Points has improved accessibility in remote areas, bridging the gap between banking services and underserved communities.

The adoption of technology-driven solutions has accelerated the pace of financial inclusion, enabling convenient and secure transactions through digital platforms and mobile banking. Moreover, the focus on credit and insurance accessibility has provided vulnerable populations with the necessary financial tools and protection, fostering economic empowerment and resilience.

Important Links