Fiscal Policy is a tool used by governments to manage the economy by adjusting its spending levels and taxation rates. The main goal of fiscal policy is to promote economic growth, control inflation, and stabilize the economy. In this article, we will discuss the basics of fiscal policy and its role in the economy.

Table of Contents

Overview of Fiscal Policy

Fiscal policy is the government’s use of its spending and taxation powers to influence the economy. It involves the government using its power to tax, spend, and borrow money to achieve economic goals. Fiscal policy is implemented by the government through the budget, which outlines how the government plans to raise and spend money over a specific period of time.

The Role of Fiscal Policy

Fiscal policy can be used to address a wide range of economic issues. It can be used to promote economic growth, by increasing government spending or cutting taxes, which can stimulate demand for goods and services, leading to increased economic activity. Fiscal policy can also be used to control inflation by reducing government spending or raising taxes, which can decrease the demand for goods and services, leading to lower prices.

Types of Fiscal Policy

Fiscal policy can be expansionary or contractionary. Expansionary fiscal policy involves increasing government spending or reducing taxes, which can stimulate economic activity, increase employment, and promote economic growth. Contractionary fiscal policy involves reducing government spending or increasing taxes, which can slow down economic activity, reduce inflation, and prevent the economy from overheating.

Expansionary Fiscal Policy

Expansionary Fiscal Policy refers to the use of government spending, taxation, and other fiscal policies to boost economic activity during a downturn. The main goal of expansionary fiscal policy is to increase aggregate demand and stimulate economic growth.

In an expansionary fiscal policy, the government can:

- Increase government spending: The government can increase its spending on infrastructure, social welfare programs, and other projects. This leads to increased demand for goods and services, which can stimulate economic growth.

- Decrease taxes: The government can reduce taxes for individuals and businesses, which leaves them with more disposable income. This increases their purchasing power and can lead to increased demand for goods and services.

- Increase transfer payments: The government can increase transfer payments such as unemployment benefits, social security payments, and other social welfare programs. This increases the income of households, which can lead to increased consumption and demand for goods and services.

Expansionary fiscal policy can be effective in the short term in boosting economic growth, reducing unemployment, and increasing consumer spending. However, it can also lead to higher inflation and increased government debt if not managed properly.

Contractionary Fiscal Policy

Contractionary Fiscal Policy refers to the use of government spending, taxation, and other fiscal policies to reduce economic activity during periods of high inflation or when the economy is overheating. The main goal of contractionary fiscal policy is to decrease aggregate demand and reduce inflationary pressures.

In a contractionary fiscal policy, the government can:

- Decrease government spending: The government can reduce its spending on infrastructure, social welfare programs, and other projects. This decreases demand for goods and services, which can reduce inflationary pressures.

- Increase taxes: The government can increase taxes for individuals and businesses, which reduces their disposable income. This decreases their purchasing power and can lead to decreased demand for goods and services.

- Decrease transfer payments: The government can decrease transfer payments such as unemployment benefits, social security payments, and other social welfare programs. This decreases the income of households, which can lead to decreased consumption and demand for goods and services.

Contractionary fiscal policy can be effective in the short term in reducing inflation and controlling economic growth. However, it can also lead to higher unemployment and decreased consumer spending if not managed properly.

Tools of Fiscal Policy

Fiscal policy tools are the various measures used by the government to influence the economy through its spending and taxation policies. Here are some of the main fiscal policy tools:

- Government Spending: The government can increase or decrease its spending on various projects and programs, such as infrastructure, defense, education, and healthcare. By increasing government spending, the government can boost demand in the economy and stimulate economic growth.

- Taxation: The government can increase or decrease taxes on individuals and businesses. By reducing taxes, the government can increase disposable income, which can stimulate spending and boost economic growth. On the other hand, by increasing taxes, the government can reduce demand and inflationary pressures.

- Transfer Payments: Transfer payments are payments made by the government to individuals or households, such as social welfare programs like unemployment benefits and food stamps. By increasing transfer payments, the government can increase disposable income and stimulate spending, which can help to boost economic growth.

- Public Debt Management: The government can manage its public debt by issuing bonds and other securities to investors, which can be used to finance its spending programs. The government can also buy back its own securities to reduce the outstanding debt and interest payments.

- Automatic Stabilizers: These are fiscal policies that are built into the economy and automatically stabilize the economy during recessions and expansions. Examples include unemployment insurance and progressive taxation.

These fiscal policy tools can be used in various combinations to achieve different macroeconomic objectives such as promoting economic growth, reducing inflation, and maintaining price stability.

Examples of Fiscal Policy

An example of expansionary fiscal policy is the government increasing spending on infrastructure projects, such as building roads, bridges, and airports, which can create jobs and boost economic activity. An example of contractionary fiscal policy is the government raising taxes on consumer goods, which can reduce consumer spending and slow down economic activity.

Fiscal Policy and Business Cycles

Fiscal policy plays a significant role in managing business cycles, which are the fluctuations in economic activity that occur over time. During a recession, fiscal policy can be used to stimulate economic growth and boost employment. During an expansion, fiscal policy can be used to control inflation and promote sustainable growth.

During a recession, expansionary fiscal policy can be used to boost economic activity by increasing government spending, decreasing taxes, and increasing transfer payments. This helps to increase aggregate demand in the economy, which can stimulate economic growth and reduce unemployment.

On the other hand, during an expansion, contractionary fiscal policy can be used to reduce inflationary pressures by decreasing government spending, increasing taxes, and reducing transfer payments. This helps to reduce aggregate demand in the economy, which can help to control inflation and promote sustainable growth.

It’s important to note that fiscal policy can have a lagged impact on the economy, meaning that its effects may not be immediately felt. It can take several months or even years for fiscal policy to have a significant impact on the economy. This is why it’s important for policymakers to be proactive in their use of fiscal policy tools, to ensure that the economy is able to weather business cycle fluctuations effectively.

Fiscal Policy and Income Distribution

Fiscal policy is the use of government spending and taxation to influence the economy. One of the goals of fiscal policy is to achieve greater income distribution, which means reducing income inequality by making sure that wealth and income are more evenly distributed across society.

There are several ways in which fiscal policy can impact income distribution. One way is through progressive taxation, where higher income earners are taxed at a higher rate than lower income earners. This can help to redistribute income from the rich to the poor, and reduce income inequality.

Another way is through government spending on social welfare programs such as healthcare, education, and housing. These programs can provide support to those who are struggling financially, and help to lift them out of poverty.

Fiscal policy can also impact income distribution through its effects on economic growth. If fiscal policy leads to strong economic growth, this can create more job opportunities and increase wages, which can help to reduce income inequality.

However, it’s important to note that the impact of fiscal policy on income distribution can be complex, and there may be unintended consequences. For example, if taxes are raised too high, this can discourage entrepreneurship and investment, and lead to slower economic growth. Similarly, if government spending on social welfare programs is too high, this can lead to a larger budget deficit and higher national debt, which can have negative effects on the economy in the long run.

Overall, fiscal policy can be an important tool for promoting greater income distribution, but it must be implemented carefully and with a long-term perspective to avoid unintended consequences.

Who implements fiscal policy in India?

Fiscal policy in India is implemented by the government through the Ministry of Finance. The Ministry of Finance formulates and implements fiscal policy in consultation with the Reserve Bank of India (RBI), which is responsible for monetary policy in the country.

The government prepares an annual budget, which outlines its fiscal policy priorities for the year. The budget includes estimates of government revenue and expenditure, as well as policy measures such as tax reforms, infrastructure spending, and social welfare programs.

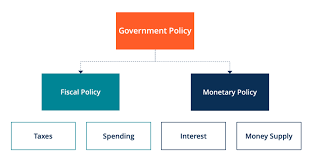

Differences between Fiscal Policy and Monetary Policy

| Criteria | Fiscal Policy | Monetary Policy |

|---|---|---|

| Definition | Refers to the use of government spending and taxation to influence the economy | Refers to the use of the central bank’s control over the money supply and interest rates to influence the economy |

| Goal | To achieve macroeconomic objectives such as economic growth, employment, and price stability | To control inflation, stabilize the currency, and promote economic growth |

| Authority | Central government (Ministry of Finance) | Central bank (Reserve Bank of India) |

| Tools | Government spending, taxation, and subsidies | Open market operations, reserve ratios, and interest rates |

| Impact on Economy | Takes time to implement and have an impact | Takes less time to implement and have an impact |

| Impact on Public | Can directly affect individuals and firms through changes in taxes, subsidies, and government spending | Can indirectly affect individuals and firms through changes in interest rates and credit availability |

Criticisms of Fiscal Policy

- Time lags: There can be a significant time lag between implementing fiscal policy and seeing its effects on the economy. This can make it difficult to time fiscal policy measures correctly.

- Crowding out: Fiscal policy can lead to crowding out, where increased government borrowing and spending leads to higher interest rates and reduces private investment, which can counteract the intended stimulus effect.

- Political influence: Fiscal policy decisions can be influenced by politics, which can lead to inefficient and ineffective policies.

- Inflexibility: Fiscal policy measures can be slow to adjust to changes in the economy, making it difficult to respond quickly to sudden changes.

- Inflationary pressures: If fiscal policy leads to increased government spending and higher aggregate demand, it can lead to inflationary pressures in the economy.

Overall, while fiscal policy can be an important tool for managing the economy, it is not without its limitations and criticisms.

Conclusion

Fiscal policy is an important tool for managing the economy and promoting economic growth. It is used by governments to influence the economy by adjusting its spending levels and taxation rates. By implementing fiscal policies, governments can address a wide range of economic issues, such as controlling inflation and promoting economic growth. Understanding the basics of fiscal policy is crucial for individuals and businesses, as it can help them make informed decisions about their investments and financial planning.

Summary

- Fiscal policy is the government’s use of its spending and taxation powers to influence the economy.

- It involves the government using its power to tax, spend, and borrow money to achieve economic goals.

- Fiscal policy is implemented by the government through the budget.

- The government can use fiscal policy to promote economic growth and control inflation.

- Fiscal policy can be expansionary or contractionary.

- Expansionary fiscal policy involves increasing government spending or reducing taxes to stimulate economic growth.

- Contractionary fiscal policy involves reducing government spending or increasing taxes to reduce inflationary pressures.

- Fiscal policy tools include government spending, taxation, transfer payments, public debt management, and automatic stabilizers.

- Government spending can be used to boost demand in the economy and stimulate economic growth.

- Taxation can be used to reduce demand and inflationary pressures.

- Transfer payments can increase disposable income and stimulate spending.

- Public debt management can be used to finance government spending programs.

- Automatic stabilizers are built-in fiscal policies that stabilize the economy during recessions and expansions.

- Fiscal policy can be used to manage business cycles by stimulating economic growth during a recession and controlling inflation during an expansion.

- Expansionary fiscal policy can be used to increase aggregate demand and reduce unemployment during a recession.

- Contractionary fiscal policy can be used to reduce inflationary pressures during an expansion.

- Fiscal policy can lead to higher inflation and increased government debt if not managed properly.

- Fiscal policy can be effective in the short term but may have long-term consequences.

- Examples of expansionary fiscal policy include increasing spending on infrastructure projects.

- Examples of contractionary fiscal policy include raising taxes on consumer goods.

Questions

Q. Which of the following is an example of expansionary fiscal policy?

A) Increasing taxes on luxury goods

B) Decreasing government spending on infrastructure projects

C) Reducing transfer payments such as unemployment benefits

D) Increasing government spending on social welfare programs

The correct answer is D) Increasing government spending on social welfare programs.

Explanation:

Expansionary fiscal policy involves increasing government spending, reducing taxes, or increasing transfer payments, all of which stimulate economic activity and increase aggregate demand.

Important Links