Inflation is defined as the general increase in the prices of goods and services over a period of time. It is measured as the percentage increase in the average price level of a basket of goods and services in an economy. It can be caused by a variety of factors, including an increase in demand, a decrease in supply, changes in production costs, and changes in the value of currencies. Lets start the discussion with basic understanding of supply and demand.

Table of Contents

Concepts of Demand and Supply

Demand refers to the quantity of a good or service that consumers are willing and able to buy at a given price and time period. In general, as the price of a good or service increases, the quantity demanded decreases, and vice versa. This relationship between price and quantity demanded is called the law of demand.

For example, let’s consider the market for smartphones. As the price of smartphones increases, consumers may choose to buy fewer phones or delay their purchases. However, if the price of smartphones decreases, consumers may be willing to buy more phones or upgrade their existing phones.

Supply, on the other hand, refers to the quantity of a good or service that producers are willing and able to sell at a given price and time period. In general, as the price of a good or service increases, the quantity supplied increases, and vice versa. This relationship between price and quantity supplied is called the law of supply.

For example, let’s consider the market for wheat. As the price of wheat increases, farmers may be willing to plant more wheat and invest in more resources, such as fertilizers and irrigation, to increase their output. However, if the price of wheat decreases, farmers may choose to plant less wheat or switch to other crops that are more profitable.

The interaction between demand and supply determines the market equilibrium price and quantity. When the quantity demanded equals the quantity supplied, the market is in equilibrium, and the price and quantity are stable. If the quantity demanded exceeds the quantity supplied, there is a shortage, and the price may increase to reach equilibrium. If the quantity supplied exceeds the quantity demanded, there is a surplus, and the price may decrease to reach equilibrium.

Causes of Inflation

- Demand-Pull Inflation: It occurs when the demand for goods and services exceeds the supply, causing prices to rise. This can happen due to a variety of factors, including an increase in consumer confidence, an increase in government spending, or a decrease in taxes. When demand for goods and services is high, it can lead to increased competition among consumers, causing prices to rise.

- Cost-Push Inflation: It occurs when the cost of producing goods and services increases, causing prices to rise. This can happen due to factors such as an increase in raw material costs, an increase in labor costs, or an increase in taxes. When production costs rise, businesses may choose to increase their prices in order to maintain their profit margins. This can lead to a general increase in the price level, as other businesses may also increase their prices in response.

Effects of Inflation

There are multi-dimensional effects of inflation on an economy both at the micro and macro levels. It redistributes income, distorts relative prices, destabilizes employment, tax, saving and investment policies and finally it may bring in recession and depression in an economy.

- On Creditors and Debtors: Inflation redistributes wealth from creditors to debtors i.e. lenders suffer and borrowers benefit out of inflation.

- On lending: With the rise in inflation, lending institutions feel the pressure of higher lending. Institutions don’t revise the nominal rate of interest as the ‘real cost of borrowing’ (i.e. nominal rate of interest minus inflation) falls by the same percentage with which inflation rises.

- On Aggregate Demand: Rising inflation indicates rising aggregate demand and indicates comparatively lower supply and higher purchasing capacity among the consumers. Usually, higher inflation suggests the producers to increase their production level as it is generally considered as an indication of higher demand in the economy.

- On Investment: Investment in the economy is boosted by the inflation (in the short-run) because of two reasons: First, higher inflation indicates higher demand and suggests entrepreneurs to expand their production level, and second, higher the inflation, lower the cost of loan.

- On Saving: Holding money does not remain an intelligent economic decision (because money loses value with every increase in inflation) that is why people visit banks more frequently and try to hold least money with themselves and put maximum with the banks in their saving accounts.

- On Tax: Tax-payers suffer while paying their direct and indirect taxes. As indirect taxes are imposed on actual market price of the product and services, increased prices of goods make tax-payers to pay increased indirect taxes. Further, direct tax burden of the tax-payers also increases as tax-payer’s gross income moves to the upward slabs of official tax brackets.

- On Exchange Rate: With every inflation the currency of the economy depreciates (loses its exchange value in front of a foreign currency) provided it follows the flexible currency regime. Though it is a comparative matter, there might be inflationary pressure on the foreign currency against which the exchange rate is compared.

- On Export: People abroad have to pay more for the goods which they were buying from your country. So your exports will decrease because people will try to look for alternatives for the same goods which they were buying from you.

- On Import : There might not be a direct impact on imports but there may be an indirect effect. Since prices have increased for most of the products people in your country might find importing the same products from outside cheaper. At the same time, the domestic currency devaluated and you need to pay more dollars to import the same product.

- On Trade Balance: In the case of a developed economy, inflation makes trade balance favorable while for the developing economies inflation is unfavorable for their trade balance. This is because of composition of their foreign trade. The benefit to export which inflation brings in to a developing economy is usually lower than the loss they incur due to their compulsory imports which become costlier due to inflation.

- On Employment: Inflation increases employment in the short-run but becomes neutral or even negative in the long run.

- On Economy: A particular level of inflation is healthy for an economy. This specific level of inflation was called as the ‘range’ of inflation and every economy needs to calculate its own range. Inflation beyond both the limits of the range is never healthy for any economy. In the case of India it is considered 4 to 5 per cent which is also known as the ‘comfort zone’ of inflation in India.

Impacts of Inflation

Inflation can have a significant impact on an economy. It can affect the purchasing power of consumers, the profitability of businesses, and the overall economic growth of a country. High inflation can cause interest rates to rise, making borrowing more expensive and reducing investment. It can also lead to a decline in the value of the currency, which makes imports more expensive and can lead to a decline in living standards.

How to Control Inflation?

- Supply-side Measure: In the short term, you need to boost the supply of goods and services in demand. The government may resort to importing goods under stress like Onion, Oil Seeds etc. As a long-term measure, governments increase production to meet demand. Storage, transportation, distribution, and hoarding are other aspects of price management in this category.

- Cost-side measures: The governments can try to reduce the price by lowering the production cost of the commodities that show a price increase through tax relief – reduction in excise duty and tariff (as was done in India in June 2003 in the case of crude oil and steel8). This is helpful as a short-term measure. In the long term, better production processes.

- Monetary Policy Measures: Governments may resort to tighter monetary policy to cool either demand-led or cost-led inflation. This is essentially to reduce the money supply in the economy by siphoning off additional money.

Types of Inflation

- Low inflation: Such inflation is slow and proceeds along predictable trajectories that might be called low or gradual. This is a comparative term that contrasts it with faster, stronger, and unpredictable inflation. Low inflation takes place over a longer period of time, and the increase is usually in single digits. Such inflation is also referred to as ‘creeping inflation.

- Galloping inflation: This is “very high inflation” in the double or triple digits (i.e., 20%, 100%, or 200% per year). The Russian economy experienced such inflation after the collapse of the former USSR in the late 1980s.

- Hyper Inflation: This form of inflation is a “large and accelerating inflation” that can have annual rates in the millions or even trillions . In such inflation, not only is the range of increase very wide, but the increase also occurs in a very short period of time, with prices shooting up overnight. The best example of hyperinflation that economists cite is of Germany after the First World War—in early 1920s.

What is Bottleneck Inflation

It occurs when supply decreases drastically and demand remains the same.

Such situations arise due to supply-side accidents, hazards, or mismanagement and are also referred to as structural inflation’. It could be categorized as “demand-pull inflation”.

What is core inflation?

This nomenclature is based on the inclusion or exclusion of goods and services in the calculation of inflation. Core inflation, which is common in Western economies, shows the increase in prices of all goods and services except energy and food. In India, it was first used in fiscal year 2000/01, when the government declared that inflation was under control-that is, that prices of manufactured goods were under control. This was criticized by experts because food and energy were excluded from inflation and people were satisfied on the inflation front. In Western economies, food and energy are basically not the problem for the masses, whereas in India, these two areas are the most important for them.

Important Terms

Inflation Tax

Inflation erodes the value of money, and people who own money suffer from this process. Since governments are empowered to print money and circulate it in the economy (as in the case of deficit spending), this act acts as income for governments. This is a situation where government spending is maintained at the expense of citizens’ income. This looks like inflation acts like a tax.

Inflation Spiral

An inflationary situation in an economy that results from a process of interaction between wages and prices . When wages push prices up and prices pull wages up, this situation is called an inflationary spiral. It is also referred to as a wage-price spiral.

Inflation Accounting

This term is widely used in the field of profit determination of companies. Basically, the profit of companies/businesses is overstated due to inflation. When a company calculates its profits after adjusting for the effects of current inflation, this process is called inflation accounting.

Inflation Premium

The bonus that inflation brings to borrowers is called the inflation premium. The interest that banks charge on their loans is called the nominal interest rate, which is not necessarily the real cost that the borrower pays to the banks. To calculate the real cost a borrower pays for their loan, the nominal interest rate is adjusted for the effects of inflation, and the interest rate wethen get is called the real interest rate. The real interest rate is always lower than the nominal interest rate when inflation takes place – the difference is the inflation premium.

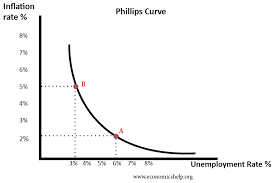

Phillips Curve

This is a graphical curve that shows the relationship between inflation and unemployment in an economy. According to the curve, there is a ‘trade off’ between inflation and unemployment, that is, an inverse relationship between the two.

The curve suggests that lower inflation leads to higher unemployment and higher inflation leads to lower unemployment.

Reflation

Reflation is a situation that is often deliberately brought about by the government to reduce unemployment and increase demand by seeking higher economic growth. Governments opt for higher public spending, tax cuts, interest rate cuts, etc.

When the economy goes through a recession cycle (low inflation, high unemployment, low demand, etc.) and the government makes some economic policy decisions to bring the economy out of recession, the prices of certain goods suddenly and temporarily increase, this price increase is also called reflation.

Stagflation

A situation in an economy in which, contrary to popular belief, inflation and unemployment are at a higher level. The conventional assumption that there is a trade-off between inflation and unemployment was disproved, and several economies moved to alternative economic policy. When the economy goes through a stagnation cycle and the government shifts economic policy, there is a sudden and temporary increase in the price of some goods-such inflation is also called stagflation. Stagflation is basically a combination of high inflation and low growth.

Inflation Targeting

The announcement of an official target range for inflation is called inflation targeting. It is undertaken by an economy’s central bank as part of its monetary policy to achieve the goal of a stable inflation rate (the Government of India entrusted the RBI with this task in the early 1970s).

New Zealand was the first economy to adopt an inflation target in 1989 , which has since been adopted by almost all economies. In the case of India, the target is between 4 and 5 percent, which is also considered the comfort zone for inflation in India.

Skewed inflation

Economists usually distinguish between inflation and a relative price increase. the term “inflation” refers to a persistent, general increase in prices, while the term ” relative price increase” refers to an episodic increase in prices of one or a small group of goods. This leaves a third phenomenon, a price increase in one or a small group of goods over an extended period of time, without a traditional term. Skewflation is a relatively new term that describes this third category of price increase.

In India, food prices rose steadily in the last months of 2009 and the first months of 2010, while non-food prices remained relatively stable. As this somewhat unusual phenomenon persisted, policymakers deliberated on how to end it.

GDP Deflator

This is the ratio between GDP at Current Prices and GDP at Constant Prices. If GDP at Current Prices is equal to the GDP at Constant Prices, GDP deflator will be 1, implying no change in price level. If GDP deflator is found to be 2, it implies rise in price level by a factor of 2, and if GDP

deflator is found to be 4 , it implies a rise in price level by a factor of 4.

Base Effect

It refers to the impact of the rise in price level (i.e. last year’s inflation) in the previous year over the corresponding rise in price levels in the current year (i.e., current inflation). If the price index had

risen at a high rate in the corresponding period of the previous year, leading to a high inflation rate,

some of the potential rise is already factored in, therefore, a similar absolute increase in the Price

index in the current year will lead to a relatively lower inflation rates.

Important Links