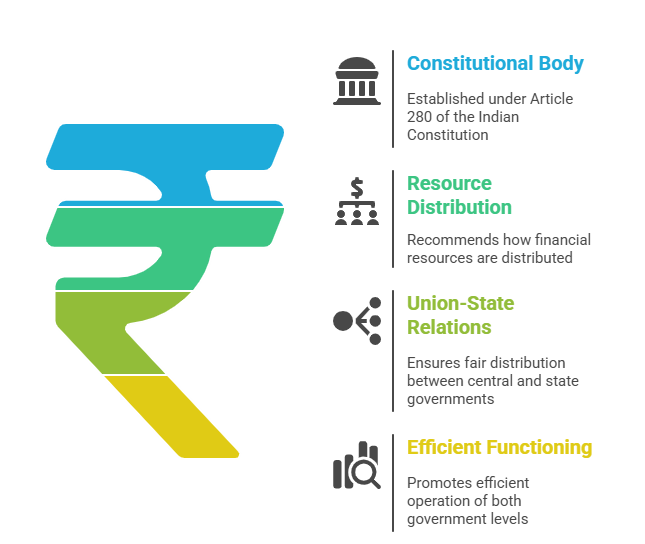

Finance commission is a constitutional body established under Article 280 of the Indian Constitution. responsible for recommending how financial resources should be distributed between the Union (Central Government) and the States. Its main role is to ensure a fair distribution of revenues so that both levels of government can function efficiently. Its recommendation is normally not rejected by the government. However, the recommendation of finance commission is only advisory and not binding.

- Purpose: The primary purpose of the Finance Commission is to recommend the distribution of tax revenues between the Union government and the state governments and among the states themselves.

- Composition: The Finance Commission is comprised of a Chairman and four other members appointed by the President of India.

- Frequency: The Finance Commission is constituted every five years, or at such other intervals as may be specified by the President.

- Duties: The Finance Commission’s duties include making recommendations on the distribution of net proceeds of taxes between the Union and the states, the principles governing grants-in-aid to the states from the Consolidated Fund of India, and measures needed to augment the Consolidated Fund of a state to supplement the resources of the panchayats and municipalities.

- Impact: The recommendations of the Finance Commission have a significant impact on the financial relationship between the Union government and the state governments and on the fiscal transfers to states.

- Independence: The Finance Commission functions independently, without being bound by the government’s directives, and its recommendations are binding on the government.

Note: The finance commission submits its report to the president who tables it in parliament.