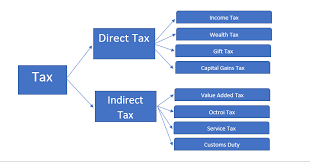

Taxation is an essential aspect of any economy. It is the process of collecting taxes from the citizens of a country to fund various government programs and services. In India, the taxation system is divided into two categories: direct taxes and indirect taxes. Direct taxes are levied directly on individuals, while indirect taxes are imposed on goods and services.

In this article, we will delve deeper into the Indian taxation system, discussing the various types of taxes, taxation authorities, and recent taxation reforms. Lets start with the types of taxes.

Table of Contents

Direct Taxes

Direct taxes are those taxes that are levied directly on individuals or organizations. These taxes are generally progressive, meaning that the more an individual earns, the higher the percentage of tax they have to pay. The following are some examples of direct taxes in India.

Income Tax

Income tax is a direct tax that is levied on the income earned by individuals or organizations. It is levied by the Central Government of India and is the primary source of revenue for the government. The income tax rates in India are based on a slab system, where individuals are taxed at different rates based on their income levels.

Corporate Tax

Corporate tax is a direct tax that is levied on the profits earned by companies in India. It is also levied by the Central Government and is an essential source of revenue for the government. The corporate tax rate in India is based on the income level of the company and varies depending on the size of the company and the sector it operates in.

Wealth Tax

Wealth tax is a direct tax that is levied on individuals and organizations based on the value of their assets. In India, wealth tax was abolished in 2015, and now there is no wealth tax in the country.

Capital Gains Tax

Capital gains tax is a direct tax that is levied on the profit earned by an individual or organization on the sale of an asset. It is calculated by subtracting the purchase price of the asset from the selling price and taxing the resulting profit. The capital gains tax rate in India varies based on the type of asset sold and the duration of ownership.

Indirect Taxes

Indirect taxes are those taxes that are levied on goods and services. These taxes are generally regressive, meaning that the tax burden falls more heavily on low-income individuals. The following are some examples of indirect taxes in India.

Goods and Services Tax (GST)

Goods and Services Tax (GST) is an indirect tax that was introduced in India in 2017. It is a consumption-based tax that is levied on the supply of goods and services. GST has replaced various indirect taxes that were previously levied in India, such as excise duty, service tax, and value-added tax.

Excise Duty

Excise duty is an indirect tax that is levied on the production or manufacture of goods in India. It is a tax that is included in the price of the goods and is ultimately borne by the end consumer. Excise duty is levied by the Central Government of India.

Customs Duty

Customs duty is an indirect tax that is levied on goods that are imported into India. It is a tax that is levied by the Central Government and is included in the price of the imported goods. Customs duty rates in India vary depending on the type of goods imported.

Value Added Tax (VAT)

Value Added Tax (VAT) is an indirect tax that is levied on the value added to a product or service at each stage of production or distribution. It is a tax that is ultimately borne by the end consumer and is levied by the State Government in India.

Taxation Authorities

Central Board of Direct Taxes (CBDT)

The Central Board of Direct Taxes (CBDT) is the apex body that governs the administration of direct taxes in India. It is a part of the Department of Revenue under the Ministry of Finance and is responsible for formulating policies and procedures related to the administration of direct taxes, such as income tax and corporate tax. The CBDT also oversees the functioning of the income tax department and ensures that tax laws and regulations are implemented effectively.

Central Board of Indirect Taxes and Customs (CBIC)

The Central Board of Indirect Taxes and Customs (CBIC) is the apex body that governs the administration of indirect taxes in India. It is a part of the Department of Revenue under the Ministry of Finance and is responsible for formulating policies and procedures related to the administration of indirect taxes, such as goods and services tax (GST), excise duty, and customs duty. The CBIC also oversees the functioning of the indirect tax department and ensures that tax laws and regulations are implemented effectively.

State Tax Authorities

In addition to the Central Government, the State Governments in India also have the authority to levy taxes. Each state has its own tax authority that is responsible for collecting state-level taxes, such as state excise duty, state VAT, and other taxes that are specific to the state.

Taxation Reforms

Introduction of GST

The introduction of Goods and Services Tax (GST) in India was a significant taxation reform. GST is a unified tax that replaced various indirect taxes that were previously levied in India. It simplified the taxation system by introducing a single tax that is levied on the supply of goods and services. GST has helped in reducing the compliance burden for businesses and has made the taxation system more transparent.

Direct Tax Code

The Direct Tax Code is a proposed taxation reform in India that aims to simplify the direct tax laws in the country. It is expected to replace the existing Income Tax Act, 1961, and bring in significant changes to the direct tax system in India. The proposed Direct Tax Code includes provisions such as the reduction of tax rates, simplification of tax laws, and the removal of exemptions and deductions.

Taxation of Digital Transactions

With the increasing use of digital payments in India, there has been a need to reform the taxation system to include digital transactions. The government has introduced provisions to levy taxes on digital transactions such as online advertising, e-commerce transactions, and digital downloads. These provisions are aimed at bringing digital transactions under the tax net and increasing revenue for the government.

Conclusion: Taxation System in India

The Indian taxation system has undergone significant reforms over the years, with the introduction of GST being one of the most significant. The taxation system in India is complex, with different types of taxes and multiple tax authorities. However, with the introduction of technology and digital payments, the government has been able to simplify the taxation system and increase revenue. The proposed Direct Tax Code is expected to further simplify the taxation system and make it more transparent. Overall, the Indian taxation system is evolving to keep up with the changing times and is expected to continue to undergo reforms to ensure a fair and equitable system for all.

Taxation System in India: Summary

- The Indian taxation system is divided into direct and indirect taxes.

- Direct taxes are levied on income, while indirect taxes are levied on goods and services.

- The Central Board of Direct Taxes (CBDT) is responsible for administering direct taxes in India.

- The Central Board of Indirect Taxes and Customs (CBIC) is responsible for administering indirect taxes in India.

- Each state in India has its own tax authority responsible for collecting state-level taxes.

- The introduction of Goods and Services Tax (GST) simplified the taxation system by introducing a single tax on the supply of goods and services.

- The Direct Tax Code is a proposed taxation reform that aims to simplify the direct tax laws in India.

- The proposed Direct Tax Code includes provisions such as the reduction of tax rates, simplification of tax laws, and the removal of exemptions and deductions.

- Digital transactions, such as online advertising, e-commerce transactions, and digital downloads, are now subject to taxation.

- The taxation system in India is complex, with different types of taxes and multiple tax authorities.

- Technology and digital payments have helped simplify the taxation system and increase revenue.

- The GST has reduced the compliance burden for businesses and made the taxation system more transparent.

- The proposed Direct Tax Code is expected to further simplify the taxation system and make it more transparent.

- The Indian taxation system is evolving to keep up with the changing times and ensure a fair and equitable system for all.

- The income tax department is responsible for collecting income tax from individuals and businesses.

- Corporate tax is levied on the profits of companies.

- Excise duty is a tax on the production or manufacture of goods.

- Customs duty is a tax on goods that are imported into India.

- State VAT is a tax on the sale of goods within a state.

- The Indian government is committed to tax reforms to ensure a fair and transparent taxation system for all.

Taxation System in India: Questions

Q. What are direct taxes?

a) Taxes on income

b) Taxes on goods and services

c) Taxes on imports

d) Taxes on exports

Answer: a) Taxes on income. Direct taxes are levied on income, while indirect taxes are levied on goods and services.

Q. Which government authority is responsible for administering indirect taxes in India?

a) Central Board of Direct Taxes (CBDT)

b) State tax authorities

c) Central Board of Indirect Taxes and Customs (CBIC)

d) Reserve Bank of India (RBI)

Answer: c) Central Board of Indirect Taxes and Customs (CBIC)

Q. What is GST?

a) A tax on goods and services

b) A tax on income

c) A tax on imports

d) A tax on exports

Answer: a) A tax on goods and services. GST is a unified tax that replaced various indirect taxes that were previously levied in India.

Q. Which proposed taxation reform in India aims to simplify the direct tax laws in the country?

a) Income Tax Act, 1961

b) GST

c) Direct Tax Code

d) Excise Duty Act

Answer: c) Direct Tax Code

Q. What are the provisions of the proposed Direct Tax Code?

a) Reduction of tax rates

b) Simplification of tax laws

c) Removal of exemptions and deductions

d) All of the above

Answer: d) All of the above

Q. Which type of tax is levied on digital transactions such as online advertising and e-commerce transactions?

a) Income tax

b) Corporate tax

c) Excise duty

d) Digital tax

Answer: d) Digital tax. With the increasing use of digital payments in India, the government has introduced provisions to levy taxes on digital transactions.

Q. Which government authority is responsible for formulating policies and procedures related to the administration of direct taxes in India?

a) Central Board of Direct Taxes (CBDT)

b) State tax authorities

c) Central Board of Indirect Taxes and Customs (CBIC)

d) Reserve Bank of India (RBI)

Answer: a) Central Board of Direct Taxes (CBDT)

Q. Which type of tax is levied on the production or manufacture of goods?

a) Income tax

b) Corporate tax

c) Excise duty

d) Customs duty

Answer: c) Excise duty

Q. What is the purpose of tax reforms in India?

a) To increase the burden on taxpayers

b) To reduce the compliance burden for businesses

c) To make the taxation system more complex

d) To decrease revenue for the government

Answer: b) To reduce the compliance burden for businesses. The Indian government is committed to tax reforms to ensure a fair and transparent taxation system for all.

Important Links