Q1. Cause of inflation is

(a) Increase in money supply

(b) Fall in production

(c) Increase in money supply and fall in production

(d) Decrease in money supply and fall in production

(UPSC Prelims 1979)

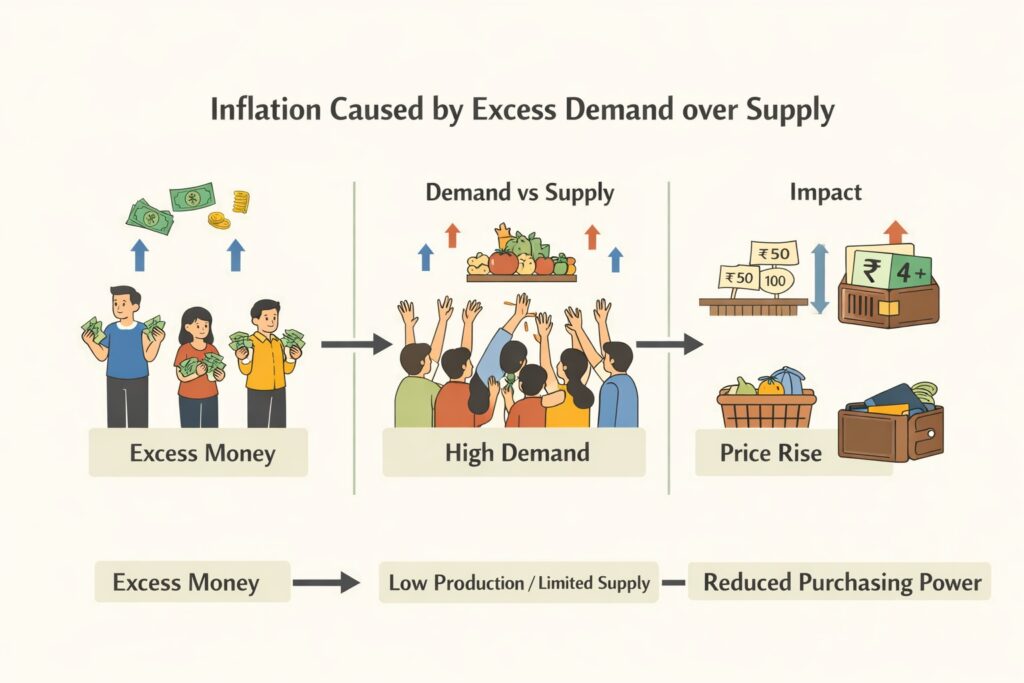

Answer: (c) Increase in money supply and fall in production

Explanation: Inflation occurs when demand exceeds supply, often due to excess money chasing fewer goods. A rise in money supply combined with declining production leads to price hikes, reducing purchasing power.

Q2. Temporary control of inflation can be effected by

(a) Increasing the prices

(b) Increasing the taxes

(c) Restraint on the growth

(d) Reducing the prices

(UPSC Prelims 1979)

Answer: (b) Increasing the taxes

Explanation: Raising taxes reduces consumer spending, thereby lowering demand. This helps in temporarily controlling inflation, as less money in circulation leads to price stabilization. It’s a common fiscal tool used by governments.

Q3. Buyers’ market denotes the place where

(a) The demand exceeds the supply

(b) The supply exceeds the demand

(c) The demand and supply are well balanced

(d) Commodities are available at competitive rates

Answer: (b) The supply exceeds the demand

Explanation: In a buyers’ market, supply outpaces demand, giving consumers more choices and bargaining power. Sellers may lower prices to attract buyers, leading to competitive pricing.

Q4. Stagflation refers to

(a) Constant rate of inflation

(b) Low inflation with high recession

(c) High inflation with low recession

(d) Stagnation and inflation

(UPSC Prelims 1984)

Answer: (d) Stagnation and inflation

Explanation: Stagflation is an economic condition where inflation is high but economic growth is stagnant, often accompanied by high unemployment. It presents a policy dilemma, as measures to reduce inflation may worsen stagnation.

Q5. Price rise goes in favour of those who are

(a) Debtors

(b) Pensioners

(c) Businessmen

(d) Government servants

Answer: (a) Debtors

Explanation:

During inflation, the real value of money decreases, which benefits debtors because they repay loans with money that is worth less than when they borrowed it. This erodes the burden of debt, making price rise favourable to them.

Q6. Which of the following pairs is/are incorrect ?

I : Consumer Price Index – Inflation

II : Export concessions – Fiscal policy

III : Imposition of taxes – Economic planning

IV : Income – Standard of living

V : Deficit budgeting – Inflation

(UPSC Prelims 1985)

Answer: (c) III and V

Explanation:

- Imposition of taxes is part of fiscal policy, not economic planning, hence III is incorrect

- Deficit budgeting may lead to inflation, but it is not a direct indicator, hence V is also incorrect